Glory Info About How To Be Sole Trader

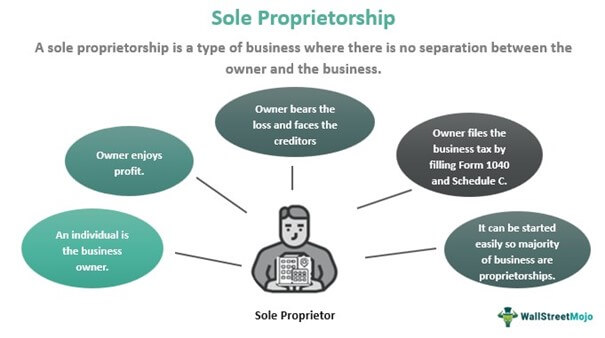

Sole trader income is taxed at the same rates as someone with a job.

How to be sole trader. This means any sales, expenses, invoices and bills related to your sole trader business will need to be retained and logged carefully throughout the financial year. You must first prove your identity using a government gateway id or gov.uk verify, then register your new. How to become a sole trader.

Use your individual tax file number when lodging your income tax return; Government licences and permits that your business needs; Check if you should set up as one.

Key elements of a sole trader. How to become a sole trader. Report all your income in your individual tax return, using the section for business items to.

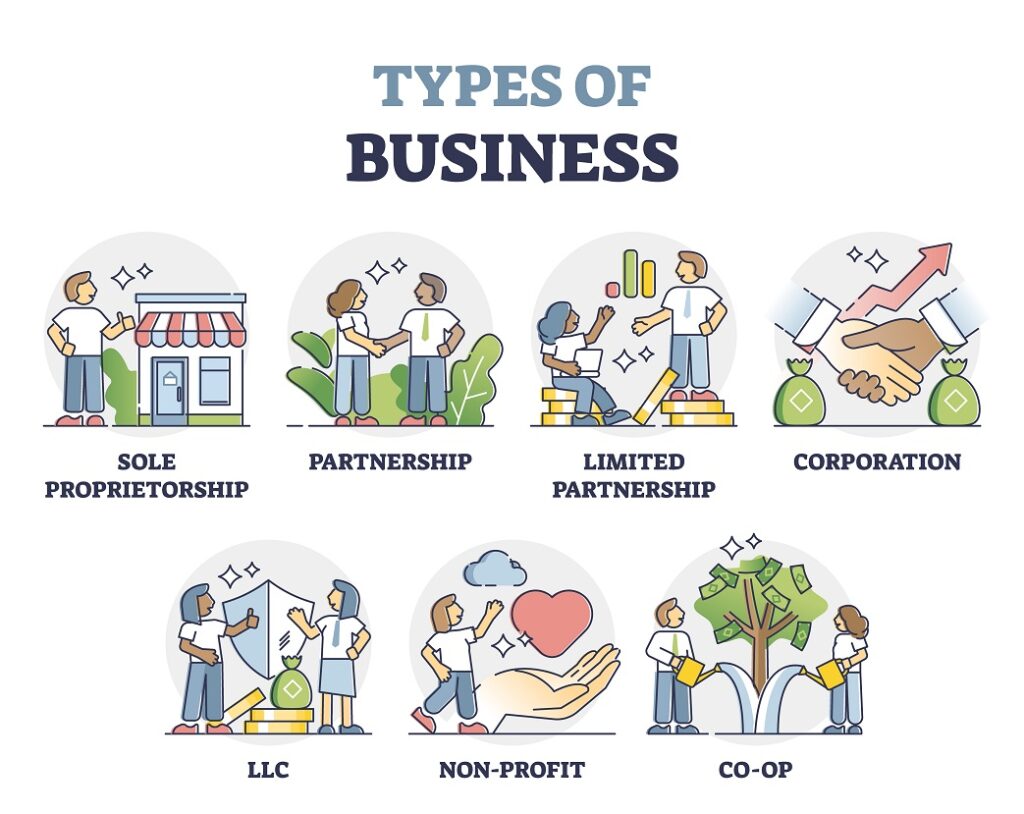

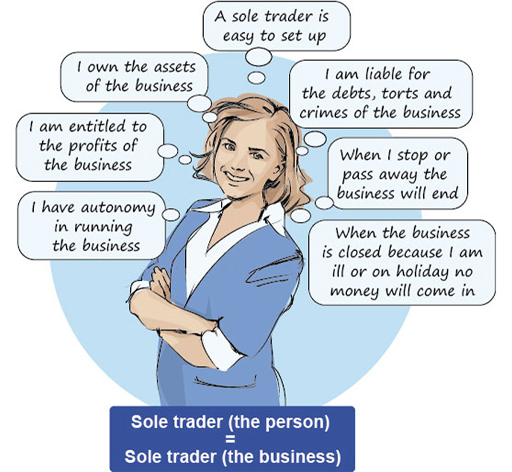

For example, as a sole trader you’ll need to:. If you’re thinking of setting up as a sole trader, there’s a few things you need to do to get started. A sole trader is the simplest form of business structure and is relatively easy and inexpensive to set up.

You need to become a sole trader if: Everything you earn as a sole trader is essentially your income and that income is subject to tax up to 55%. There are other ways to work for yourself.

Sole traders can start trading as soon as they wish, as there is no need to set up the business officially with. The invoice notifies the client that payment. A personal ird number for paying income tax and gst;

/dotdash_Final_Sole_Proprietorship_May_2020-01-72456bd5ac0d4c868d8f55a2718dbdd2.jpg)

/dotdash_Final_Sole_Proprietorship_May_2020-01-72456bd5ac0d4c868d8f55a2718dbdd2.jpg)